Understanding VA Dependency and Indemnity Compensation (DIC) Benefits for Surviving Family Members

Category: Veterans Disability Law

Article by Tuley Law staff

For military veterans and their families, their dedication and commitment often come at a great personal price. In recognition of those sacrifices, the Department of Veterans Affairs (VA) provides Dependency and Indemnity Compensation (DIC) benefits.

Specifically, these tax-free DIC benefits aim to assist the surviving spouses and dependent children of military personnel who have tragically lost their lives due to service-related causes. The benefits help ease the burden of their loss and provide support for the future.

This article will explore the DIC program in detail, discussing its eligibility requirements and how to apply for benefits. We will discuss the compensation rates for surviving spouses and dependent children. We will also address common questions and concerns regarding DIC benefits, including how they may affect other VA benefits or pensions.

Eligibility for DIC Benefits

To be eligible for DIC benefits, you must meet specific criteria established by the VA. The requirements focus on the relationship to the deceased veteran and the circumstances surrounding their death.

The DIC Relationship Eligibility Criteria:

| Relationship | Requirements |

|---|---|

| Remarried Spouse | Remarried after Dec.16, 2003, and were 57 or older at remarriage OR Remarried after Jan. 5, 2021, and were 55 or older at remarriage |

| Surviving Child | The child is not married AND The child is not included on the surviving spouse’s compensation AND The child is younger than 18 years old or younger than 23 if enrolled in school. *If the child is adopted out of the veteran’s family, they’ll still qualify if they meet all the other criteria. |

| Surviving Parent | Biological, adoptive, or foster parent of the Veteran AND Income is below a specified amount (refer to current DIC rates for parents) *A foster parent is identified as an individual who took on a parental role for the Veteran prior to their last active duty service. |

| Surviving Spouse | Lived with the veteran continuously until their death (OR if separated, the surviving spouse wasn’t at fault) AND at least one of the following: Married the veteran within 15 years post discharge during which a qualifying illness or injury began or worsened, OR were married to the veteran for at least one year, OR shared a child with the veteran. |

- Death occurs while on active duty, active duty for training, or inactive duty training.

- If a veteran dies due to medical care from the DVA healthcare system or while participating in Vocational Rehabilitation training, they may receive DIC benefits.

- The veteran’s death was directly caused by, or significantly influenced by a service-connected disability.

- A service-connected disability didn’t directly cause the veteran’s death, but the veteran qualified for 100% disability VA compensation.

Gathering all necessary documents and evidence to support your claim for DIC benefits is essential. The documents you may need include military service records, medical reports, and other relevant paperwork.

2024 DIC Compensation Rates for Surviving Spouses

The DIC program provides monthly compensation payments to eligible surviving spouses. Various factors, such as the date of the veteran’s death and additional qualifications, determine the amount of the monthly compensation payments. Let’s explore the compensation rates for surviving spouses in different scenarios:

2024 DIC Compensation Rates for Surviving Spouses

The DIC program provides monthly compensation payments to eligible surviving spouses. Various factors, such as the date of the veteran’s death and additional qualifications, determine the amount of the monthly compensation payments. Let’s explore the compensation rates for surviving spouses in different scenarios:

Surviving Spouse Rates if the Veteran Died on or After January 1, 1993

If you are the surviving spouse of a veteran who passed away on or after January 1, 1993, the following DIC rates for spouses apply:

| Benefit Type | Description/Amount |

|---|---|

| Monthly Payment Rate | $1,612.75 (Effective December 1, 2023) |

| 8-Year Provision | If the veteran had a VA disability rating of 100% for at least eight full years leading up to their death, and you were married to the veteran for the same eight years, you may qualify for an added monthly amount of $342.46. |

| Aid and Attendance | If you have a disability and require assistance with regular daily activities like eating, bathing, or dressing, you may qualify for an added monthly amount of $399.54. |

| Housebound Allowance | If you cannot leave your house due to a disability, you may qualify for an added monthly amount of $187.17. |

| Transitional Benefit and DIC Apportionment Rate | If you have one or more children who are under 18, you may qualify for a transitional benefit and DIC apportionment rate. For the first two years after the veteran's death, the added monthly amount is $342.00, and $399.54 for each eligible child. |

To calculate your monthly payment, start with the base rate of $1,612.75 and add the applicable amounts from the added amounts table.

For example, if you have one child under 18 and qualify for the 8-year provision, Aid and Attendance, and the transitional benefit, your monthly payment would be $3,096.29 for the first two years.

Surviving Spouse Rates if the Veteran Died Before January 1, 1993

Different criteria determine the compensation rates if you are the surviving spouse of a veteran who passed away before January 1, 1993. The rates vary based on the veteran’s pay grade and any additional qualifications.

Enlisted Veteran Pay Grades E-1 to E-9 Monthly Payment Rates

| Veteran’s Pay Grade | Monthly Payment |

|---|---|

| E-1, E-2, E-3, E-4, E-5, E-6 | $1,612.75 |

| E-7 | $1,668.49 |

| E-8 | $1,761.43 |

| E-9 Regular | $1,837.07 |

| E-9 Special Capacity (Sergeant Major of the Army or Marine Corps, Senior Enlisted Adviser of the Navy, Chief Master Sergeant of the Air Force, or Master Chief Petty Officer of the Coast Guard) | $1,983.09 |

8-Year Provision

The veteran’s pay grade must fall between E-1 and E-7 for special considerations. Additionally, the veteran must have had a VA disability rating of ‘totally disabling’ for at least eight full years before their death. You must also have been married to the veteran during those eight years. If all these conditions are met, an extra $342.46 will be added to your monthly payment.

8-Year Provision for E-8 or E-9

The veteran’s pay grade must be either E-8 or E-9 for this particular adjustment. Additionally, the veteran should have had a VA disability rating of 100% for at least eight years prior to their death. You also need to have been married to the veteran during those same eight years. If all these conditions are met, your monthly payment will increase to $1,955.21.

Dependent Children

If you have one or more children who are under 18, your monthly payment will be adjusted by an added amount of $399.54 per child.

To calculate your monthly payment, find the appropriate pay grade in the table and add any applicable added or increased amounts from the table. For example, if you are an E-3 pay grade veteran’s surviving spouse, qualify for the 8-year provision, and have one child under 18, your total monthly payment would be $2,354.75.

Warrant Officer Pay Grades W-1 to W-4 Monthly Payment Rates

The following monthly payment rates apply to surviving spouses of warrant officers in pay grades W-1 to W-4:

| Pay Grade | Monthly Payments |

|---|---|

| W-1 | $1,703.03 |

| W-2 | $1,770.71 |

| W-3 | $1,822.47 |

| W-4 | $1,928.66 |

8-Year Provision

If the veteran received a VA disability rating that was ‘totally disabling,’ it must have been for at least eight full years leading up to their death. In addition, you must have been married to the veteran during those same eight years. If both conditions are met, your monthly payment will increase to $1,955.21.

Dependent Children

If you have one or more children who are under 18, your monthly payment will be adjusted by an added amount of $399.54 per child.

Officer Pay Grades O-1 to O-10 Monthly Payment Rates

The following monthly payment rates apply to surviving spouses of officers in pay grades O-1 to O-10:

| Pay Grade | Monthly Payment |

|---|---|

| O-1 | $1,703.03 |

| O-2 | $1,761.43 |

| O-3 | $1,882.19 |

| O-4 | $1,995.01 |

| O-5 | $2,195.47 |

| O-6 | $2,475.55 |

| O-7 | $2,671.96 |

| O-8 | $2,934.81 |

| O-9 | $3,139.21 |

| O-10 Regular | $3,443.18 |

| O-10 Special Capacity (Chairman of the Joint Chiefs of Staff, Chief of Staff of the Army or Air Force, Chief of Naval Operations, Commandant of the Marine Corps) | $3,695.39 |

8-Year Provision

If the veteran had a pay grade between O-1 and O-3, certain conditions apply.

- The veteran must also have had a VA service-connected disability rating of ‘totally disabling’ for a minimum of eight full years leading up to their death.

- Additionally, you need to have been married to the veteran during these eight years.

- If all these conditions are met, your monthly payment will increase to $1,955.21.

Dependent Children

If you have one or more children who are under 18, your monthly payment will be adjusted by an added amount of $399.54 per child. To calculate your monthly payment, refer to the table and add any applicable added or increased amounts.

2024 DIC Compensation Rates for Surviving Children

The DIC program also provides compensation for surviving children of veterans. The rates vary depending on the child’s age and other qualifications. Let’s explore the compensation rates for children:

Surviving, Unmarried Adult Child of a Veteran, When the Surviving Spouse Is Also Eligible for DIC

If you are an unmarried adult child of a veteran, and the surviving spouse is also eligible for DIC benefits, you may receive a separate monthly payment. The rates are as follows:

| Description | Monthly Payment |

|---|---|

| Child Between 18 and 23 in a Qualified School Program | $338.49 |

| Helpless Child Over 18 (Permanently unable to support themselves before 18) | $680.94 |

Surviving Eligible Child of a Veteran, When the Veteran Doesn’t Have a Surviving Spouse Eligible for DIC

If the veteran does not have a surviving spouse eligible for DIC, the monthly payment for the surviving child is based on the number of eligible children. To be considered an eligible child, you must meet at least one of the following requirements:

- Under 18 years old

- Between 18 and 23 years old and in a VA-approved school program

- Permanently unable to support yourself due to a disability before age 18 (referred to as a “helpless child”)

The compensation rates for surviving eligible children are as follows:

| Number of Eligible Children | Monthly Rate for Each Child | Total Monthly Payment |

|---|---|---|

| 1 | $680.94 | $680.94 |

| 2 | $489.79 | $979.58 |

| 3 | $426.09 | $1,278.27 |

| 4 | $380.30 | $1,521.18 |

| 5 | $352.82 | $1,764.09 |

| 6 | $334.50 | $2,007.00 |

| 7 | $321.42 | $2,249.91 |

| 8 | $311.60 | $2,492.82 |

| 9 | 303.97 | $2,735.73 |

Applying for DIC Benefits

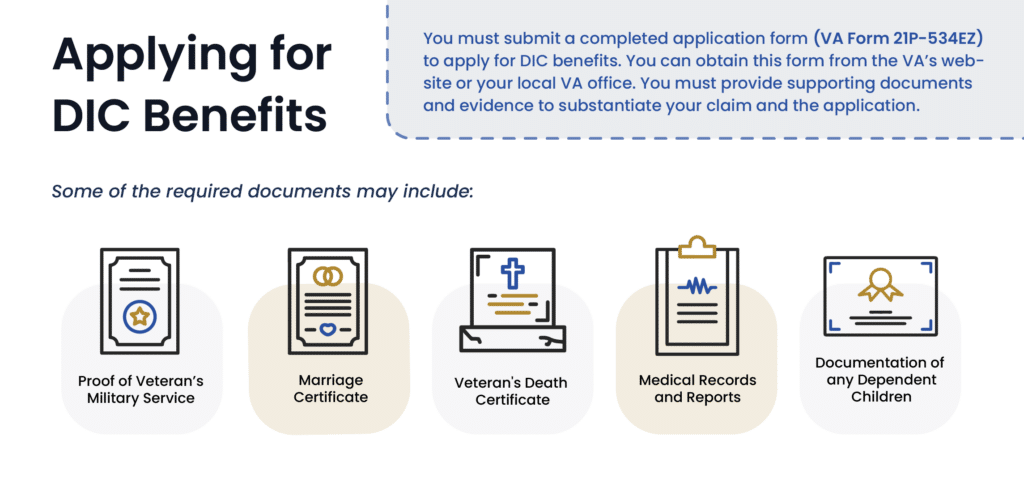

You must submit a completed application form (VA Form 21P-534EZ) to apply for DIC benefits. You can obtain this form from the VA’s website or your local VA office. You must provide supporting documents and evidence to substantiate your claim and the application.

Some of the required documents may include:

- Proof of the veteran’s military service, such as discharge or separation documents.

- Marriage certificate (if applicable) and any divorce or annulment records.

- Death certificate of the veteran.

- Medical records and reports related to the service-connected illness or injury.

- Documentation of any dependent children, such as birth certificates or adoption records.

It’s crucial to ensure that all necessary documents are included with your application to avoid delays in processing. Our expert VA disability lawyer can guide you through the application process.

DIC Benefits and Other VA Programs

DIC benefits are separate from other VA programs, such as Survivors Pensions and Survivor Benefit Plans (SBP). However, it’s essential to understand how DIC benefits may affect your eligibility for these programs.

VA Survivors Pension

If you are eligible for both DIC benefits and the VA Survivors Pension, you will receive the benefit that provides the highest payment. You cannot receive both simultaneously. The VA Survivors Pension is a needs-based benefit that offers additional financial support to eligible surviving spouses and dependent children.

Survivor Benefit Plan (SBP)

The Survivor Benefit Plan (SBP) is a voluntary annuity program that allows service members to provide a monthly income to their eligible family members after their death.

Suppose the deceased veteran or service member elected to participate in the SBP, and the surviving spouse is eligible for DIC benefits. In that case, the SBP payments may be offset or reduced by the amount of DIC compensation received. It’s crucial to review the specific terms of the SBP and consult with a financial advisor to understand the impact on your benefits.

Tuley Law Can Help You Apply for DIC Benefits

The experienced attorneys at Tuley Law Office understand the complex DIC eligibility requirements and application process. We have helped numerous military families access the benefits they deserve.

Need help navigating the DIC program? Let our dedicated team guide you. For a free consultation with a VA-accredited attorney, contact Tuley Law Office today at (812) 625-2113 or fill out the online form.

Have questions about your case?

Contact us