Comprehensive Guide: Wrongful Death Lawsuits in Indiana

Wrongful death is a devastating tragedy that can profoundly impact the lives of surviving family members. Surprisingly, the common law did not permit such actions. However, in cases where an individual’s death is caused by negligence, Indiana has passed statutes that offer recourse for the deceased’s surviving family members to pursue compensation. This may help cover expenses such as medical bills, funeral costs, as well as any emotional distress experienced by the family.

Wrongful death cases may arise from a variety of circumstances including:

- Vehicle accidents caused by reckless driving, speeding, or DUI

- Medical malpractice resulting in death

- Workplace accidents and fatalities

- Product liability

- Premises liability

- Elder neglect or abuse

- Fatal assaults or homicides

- Death caused by dangerous or toxic substances

Navigating the legal process of a wrongful death case can be challenging, which is why it is essential to have the support of an experienced wrongful death attorney. Tuley Law has the expertise and knowledge to help build a strong case and negotiate a fair settlement with the responsible party or their insurance company.

This blog will cover the basics of wrongful death settlements and provide an overview of what you can expect when losing a loved one due to someone else’s negligence or intentional harm.

Who Has The Legal Right To File A Wrongful Death Lawsuit in Indiana?

Adult Decedent

When a person dies due to another person’s wrongful act or neglect, they need a personal representative to file a claim in Indiana.

A personal representative is a person in charge of handling the estate of someone who has passed away. In Indiana, the personal representative is usually someone named in the deceased person’s will. If there’s no will, the court will appoint someone as the personal representative.

The personal representative can be a close family member, such as a spouse or child, or someone qualified to do the job. The person must be 18 years old or over, have no criminal record, and not be incapacitated or found unsuitable by the court to be eligible for the role.

Child Decedent

In Indiana, when negligence or intentional harm leads to a child’s death, the parents have two options for legal action. The first option is for both parents to bring the action together. Alternatively, one parent can bring the action and include the other parent as a co-defendant to represent their interest.

When the parents are divorced, the person awarded custody of the child can file a wrongful death claim.

The third option is for a guardian to file a lawsuit for the injury or death of a “protected person.” This may refer to a child who is not under the custody of either parent or who may be under the custody of a legal guardian.

Suppose the person who was given custody of a child has passed away. In that case, a personal representative is chosen to take over the lawsuit for the injury or death of the child.

Indiana classifies a child as:

- An unmarried individual without dependents who is younger than 20 years of age

- An unmarried individual without dependents who is younger than 23 years of age and enrolled in a college, technical school, or another post-secondary program

- A fetus that has reached viability

Who Can Receive Compensation in a Wrongful Death Settlement in Indiana

In a wrongful death lawsuit, though the personal representative handles the claim on behalf of the estate, it is the estate itself that receives the compensation in a wrongful death settlement. The beneficiaries of the estate will be determined by the decedent’s last will and testament, or, in the absence of a last will and testament, by the applicable laws of intestacy.

The compensation an individual receives depends on the circumstances of the case and their relationship to the deceased.

Spouses and dependent children may receive additional damages for the loss of future earnings and loss of love, affection, care, training, and guidance.

Compensation for loss of love and companionship may be awarded. Parents and non-dependent children must also show they have an ongoing and genuine relationship with the deceased.

If the deceased individual is a child, damages may be awarded to compensate for the loss of the child’s services, love and companionship, and any outstanding debts. The parents or minor siblings may also receive reasonable costs for counseling to help them cope with the loss.

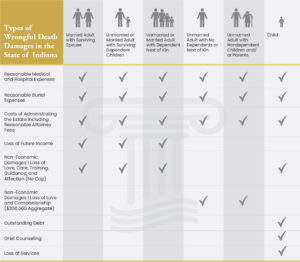

Here is a quick reference chart to the different types of wrongful death damages in Indiana.

Factors That Determine the Amount of a Wrongful Death Settlement

While no amount of money can replace a loved one, a wrongful death settlement can help ease the financial burden and provide some sense of justice. Moreover, such claims can also have the impact of discouraging the same or similar negligent behavior in the future.

Each case is unique, and the amount of compensation a family can receive will depend on the specific circumstances of the death. An experienced wrongful death attorney can help determine the full extent of the losses and work to maximize your compensation.

Several factors will impact how much you can sue for wrongful death:

Reasonable Medical and Hospital Expenses

The actual costs of the funeral and burial services typically determine funeral expenses in a wrongful death case. This can include costs like the casket, burial plot, funeral home services, transportation, and other related expenses.

If the family has already paid for the funeral expenses out of pocket, they can submit copies of the receipts and bills to the court as evidence of their expenses. If the family has not yet paid for the funeral expenses, the costs can be estimated based on the average costs for similar services in the area.

Loss of Income and Future Earning Potential

The actual costs of the funeral and burial services typically determine funeral expenses in a wrongful death case. This can include costs like the casket, burial plot, funeral home services, transportation, and other related expenses.

If the family has already paid for the funeral expenses out of pocket, they can submit copies of the receipts and bills to the court as evidence of their expenses. If the family has not yet paid for the funeral expenses, the costs can be estimated based on the average costs for similar services in the area.

Funeral and Burial Expenses

The actual costs of the funeral and burial services typically determine funeral expenses in a wrongful death case. This can include costs like the casket, burial plot, funeral home services, transportation, and other related expenses.

If the family has already paid for the funeral expenses out of pocket, they can submit copies of the receipts and bills to the court as evidence of their expenses. If the family has not yet paid for the funeral expenses, the costs can be estimated based on the average costs for similar services in the area.

Cost of Administering the Estate

The cost of administering the estate in a wrongful death case typically includes the fees of the estate’s personal representative (executor) and any legal or court costs associated with administering the estate. This may include costs like filing legal documents, paying court fees, or hiring an attorney to assist with the probate process.

Non-Economic Damages

Calculating the value of loss of love, care, affection, and companionship (non-economic damages) in a wrongful death case is often a complex and subjective process, as it involves estimating the intangible emotional value of the relationship between the deceased person and their surviving family members.

Other factors that may be considered when calculating loss of companionship include the age of the surviving family members, the duration of the relationship with the deceased person, and the emotional impact of the loss on each family member.

In Indiana, if the person who dies is an unmarried adult and has no dependent children, the non-economic damages cannot exceed $300,000. The courts will adjust the settlement amount if a jury awards more than the legal limit. If the person who dies has a spouse, dependent children, or is a child, there is no cap on the amount of non-economic damages.

Outstanding Debts

In Indiana, outstanding debts may be included as part of the damages in a wrongful death lawsuit involving a child. These could be uninsured debts like student loans or debts the parents or guardian is now responsible for paying.

Loss of Services

Under Indiana law, the damages recoverable in a wrongful death lawsuit involving a child may include damages for the loss of the child’s services, which can include the reasonable value of household services, child care, and other contributions the child would have made to the family had they lived.

Grief Counseling

In Indiana, the damages recoverable in a wrongful death lawsuit may include the reasonable expense of psychiatric and psychological counseling incurred by a surviving parent or minor sibling of the child that is required because of the child’s death.

The damages for grief counseling may also include the costs of other medical or therapeutic treatments that the surviving family members require to cope with their emotional distress, such as medication.

In general, the damages may be calculated based on the reasonable costs of the counseling services or other treatments incurred by the family members and any related expenses, such as transportation.

To support a claim for damages for grief counseling in a wrongful death lawsuit in Indiana, the surviving family members may need to provide evidence of the need for counseling or other treatments, such as documentation from mental health professionals, medical records, or testimony from witnesses who can attest to the emotional trauma experienced by the family members.

Average Compensation for Wrongful Death

Since so many factors contribute to wrongful death lawsuits, each case is unique, making it hard to determine the average compensation people receive in Indiana in all types of wrongful death lawsuits.

However, the U.S. average payout for medical negligence resulting in death in 2020 was $406,569. The medical field has reporting requirements that provide trends and averages. But every case will be different, so it’s essential to find qualified legal representation.

How Are Wrongful Death Settlements Paid Out?

In Indiana, the distribution of a wrongful death settlement is governed by the state’s statutes. The specific distribution will depend on the circumstances of the case and the surviving family members. In general, the distribution of a wrongful death settlement may be as follows:

- If the deceased had a surviving spouse and children: The settlement will be divided among the surviving spouse and children according to the laws of intestacy or the decedent’s last will and testament.

- If the deceased had a surviving spouse but no children: The entire settlement will be awarded to the surviving spouse.

- If the deceased had no surviving spouse or children: The settlement will be awarded to the next of kin in the order of preference specified by Indiana law.

Wrongful death settlements are either paid in a lump sum or a structured payment plan. In cases where one or more minor children survive the deceased person, the children’s settlements will be required to be put into restricted accounts to be held until the children reach the age of majority.

Lump Sum Payment

A lump sum payment in a wrongful death settlement is a one-time payment to the beneficiaries or surviving family members. Lump sum payments in wrongful death cases are the most common preference.

The benefit of a lump sum payment is that the beneficiaries can access all of the money at once and use it for whatever purpose they deem necessary. The drawback is that the beneficiaries may need help understanding how to manage the money and could be at risk of mismanaging it.

Structured Settlement

A structured payment plan in a wrongful death settlement is when payments are spread over time, usually several years.

Structured settlements are often used in wrongful death cases where the damages awarded are significant. The parties involved might prefer a payment plan that provides a regular income and financial security. This might also be the preferred payment plan if the beneficiaries are minors who have limited financial management experience.

The drawback to this type of settlement payment is that the beneficiaries might not be able to pay the expenses they’ve incurred because of the death of their loved one right away. Instead, they may have to negotiate a payment plan to accommodate the structured settlement. Additionally, the structured settlement payments may not keep pace with inflation, meaning the payments may be worth less in the future than they are in the present day.

Is The Settlement From A Wrongful Death Lawsuit Taxable In Indiana?

In Indiana, settlement payments in wrongful death cases are generally not taxable under state or federal law. This means that the beneficiaries or family members who receive settlement payments are typically not required to pay state or federal income taxes on the amount received.

There are some exceptions to this general rule. For example, if a portion of the settlement is for medical expenses that were written off on previous tax returns as a tax deduction.

It’s essential to consult with a qualified attorney or tax professional to understand the specific tax implications of a settlement in a wrongful death case based on the laws of the state where the case is filed.

How a Wrongful Death Attorney Can Help You

An experienced wrongful death attorney can play a critical role in helping the surviving family members recover compensation for their losses.

At Tuley Law, we will investigate the circumstances of the death and gather evidence to support the family’s case. Our team can help your family understand the full extent of your losses, including the loss of income, support, and companionship, as well as funeral and burial expenses and medical expenses.

We’ll negotiate on your behalf with the responsible party or their insurance company to help you receive the compensation you deserve. If a settlement is not reached through negotiation, we’ll help your family navigate litigation in court.

Having an experienced wrongful death attorney by your side can help ensure that your rights are protected and that you receive the compensation you deserve. Call us today for a free consultation at (812) 625-2149 or fill out our online form.